Property Taxes Payment Methods & Due Dates

Pay taxes and find more information about each parcel on the Iowa Treasurers website. Search by name, by address, or by the 12-digit parcel number listed on tax statements.

Payment Methods

- In Office - We accept cash and check, or debit/credit card for an additional fee ($2.00 for debit/2.25% for credit).

- Drop Box - Drop boxes are located both inside the lobby and in the drive-up at the Trosper Hoyt location for payments by check only (no cash) . When dropping off a tax payment, include your payment stub with your check.

- Mail - Your payment must be postmarked by the end of the month due to avoid 1.5% penalty. We recommend you pay early. Mailing the last day of the month does not guarantee a timely postmark.

- Mail payments to: Woodbury County Treasurer, 822 Douglas St Room 102, Sioux City, IA 51101

- Online - Pay through the Iowa Treasurers Website. Pay with an eCheck for only 25¢ (less than a postage stamp). Online payments by debit/credit card have a service fee of 2.25% of the total amount due.

Accepted Credit Cards: MasterCard/Visa/Discover

** Checks should be made out to Woodbury County Treasurer. Checks must have an American Bank Association (ABA) routing number. Foreign checks will not be accepted. **

A fee of $30.00 will be charged for all dishonored checks, drafts, or orders as prescribed in Iowa Code 554.3512.

Due Dates

Property taxes may be paid in full in September each year or split into two installments:

- The first half is due September 1st and becomes delinquent October 1st.

- The second half is due March 1st of the following year and becomes delinquent April 1st.

Delinquent taxes accrue interest at the rate of 1.5% per month, rounded to the nearest dollar, with a minimum penalty due of one dollar.

Tax statements are mailed once per year, generally by mid-August. If you have not received your statement by September 1st, please call us at 712-279-6495, option 2.

If your property taxes are paid by escrow, the statement you received is for your information only. It is not necessary to notify our office that your property taxes are paid by escrow.

Partial & Scheduled Payments

Woodbury County allows partial payments of current property taxes. By law, you cannot make a partial payment on a tax sale or special assessment. If at any time you want to pay towards your current property taxes, partial payments must cover a minimum of the amount of any interest due.

You can make partial payments directly to our office by mailing a check or making a payment in office.* Or, if you prefer, you may schedule automatic payments through the Iowa Treasurer website. Instructions are below.

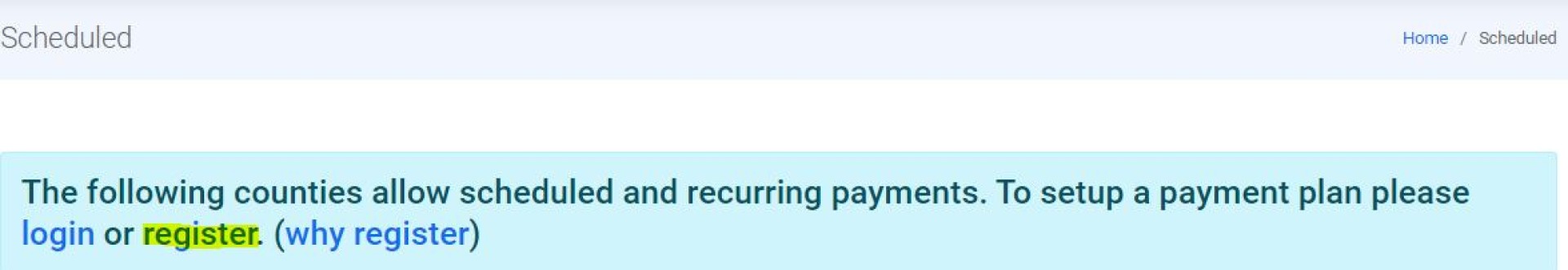

REGISTER AND LOGIN

|

1. Click "Register" to set up your username and password. 2. Once you have registered, click "login." |

|

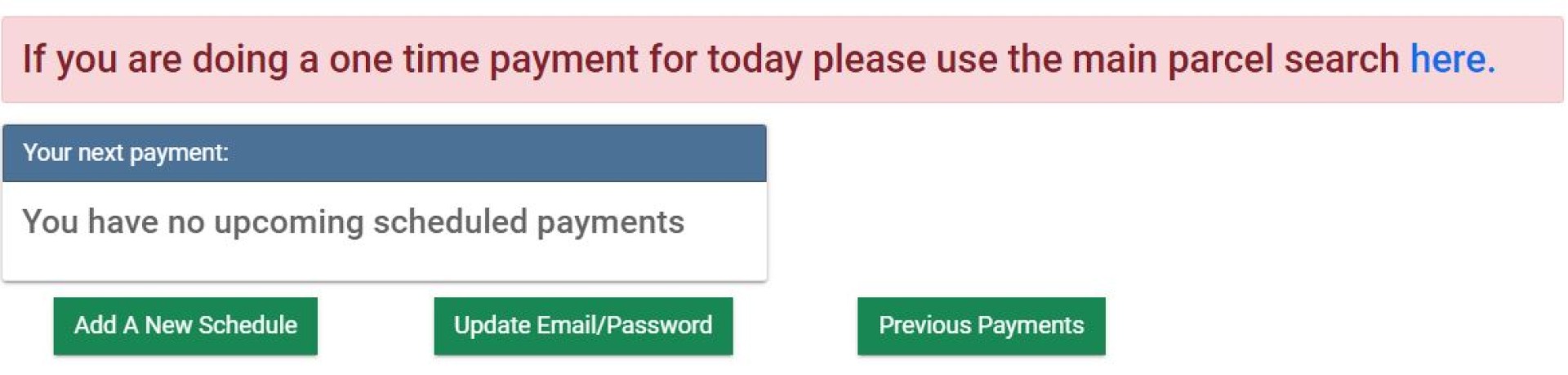

SET UP THE SCHEDULE

|

1. Click on "Add a New Schedule." |

|

|

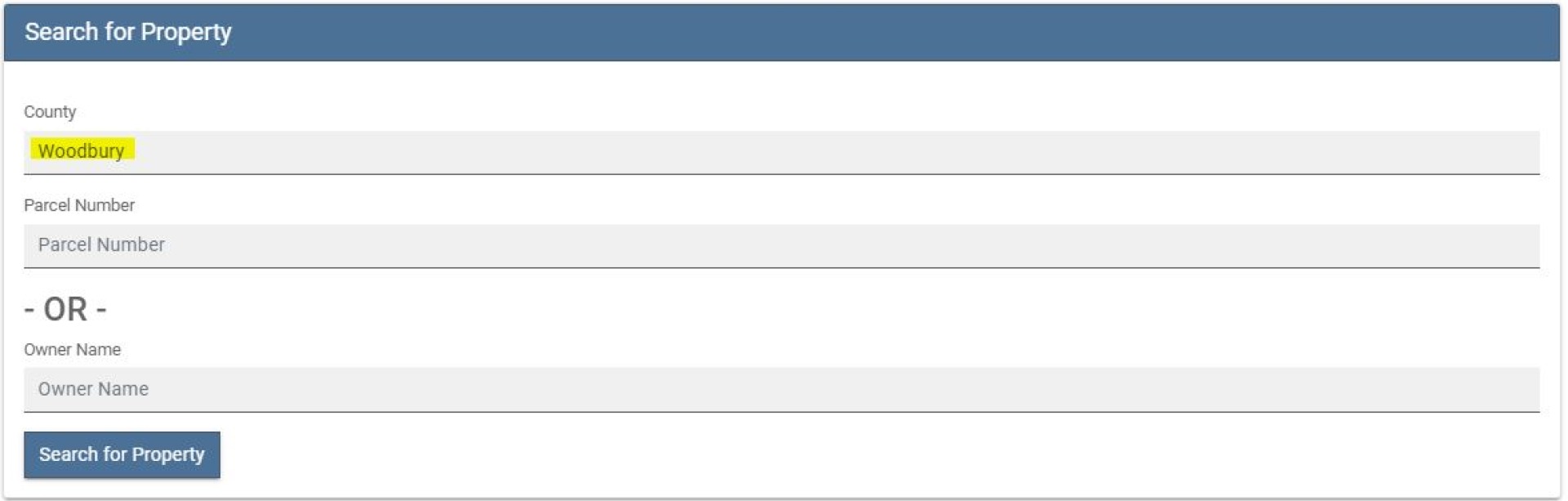

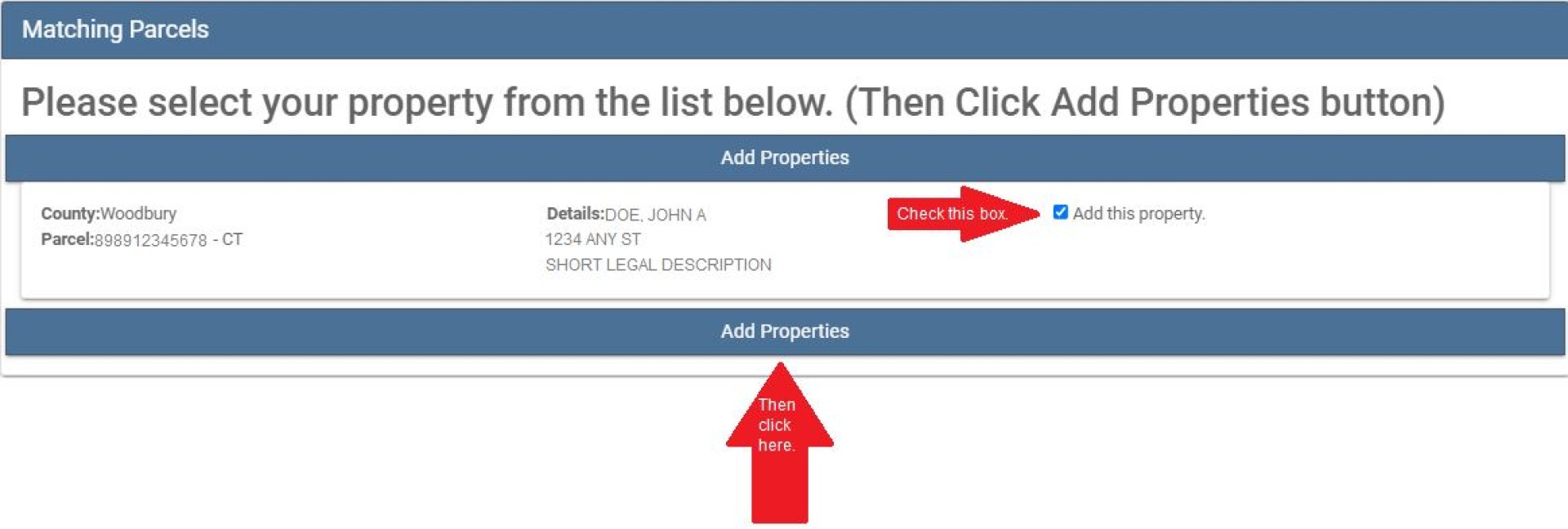

2. Click on "Add Property."

|

|

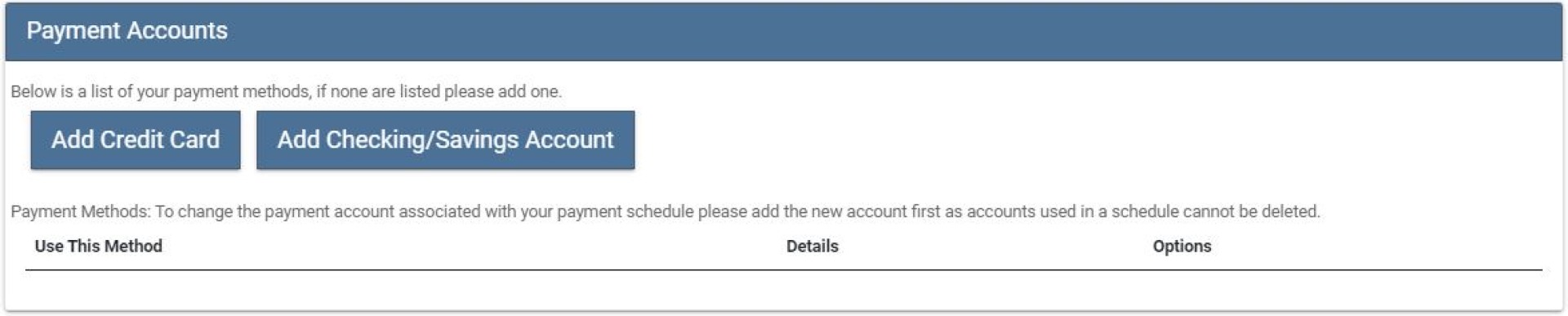

3. Set up your payment account by choosing account type.

|

|

|

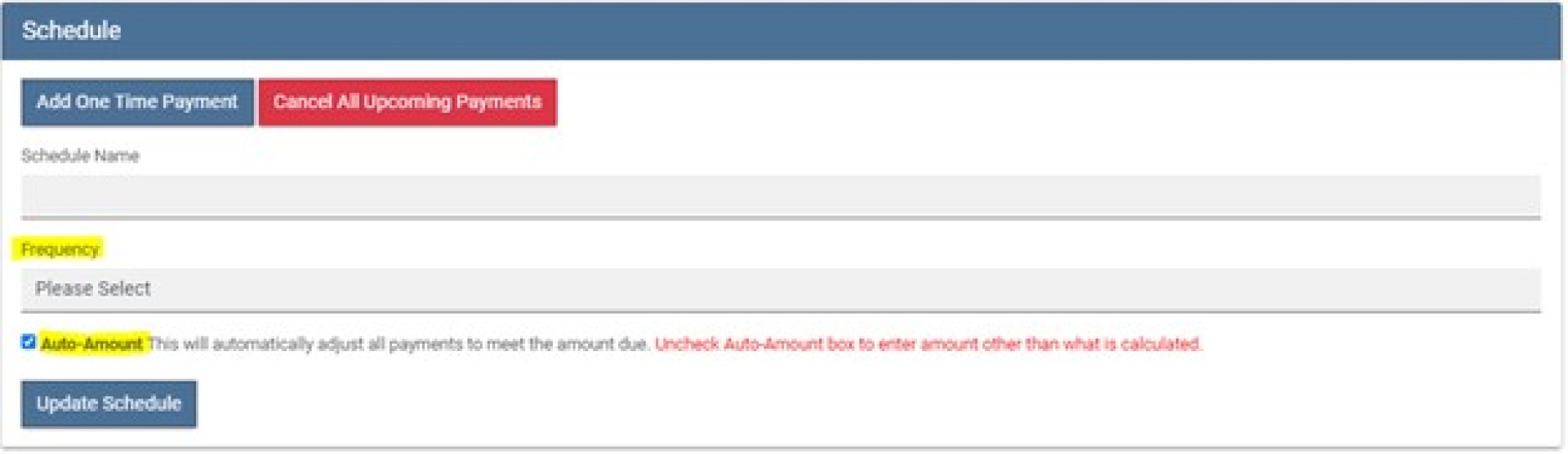

4. Choose payment frequency.

|

|

* Please note: When making partial payments, if you choose to pay a fixed dollar amount each month through the website or if you are making partial payments by mail/in person, it is your responsibility to adjust your payment amount as needed to ensure each installment is paid in full by the due dates (September 30th and March 31st). If your payments do not cover the full amount of property taxes due by the due date, you will incur interest of 1.5% per month.

Stay Connected with Our County

Stay Connected with Our County