Frequently Asked Questions

DNR

When are ATV’s/ OHV’s/ ORM’s and Snowmobile registrations renewed?

They are renewed between September 1 and December 31 for $17.75 every year.

When is my boat registration renewed?

Boat registrations are renewed every three years from January 1 through April 30. The next renewal will be due in 2025.

What is a rural user permit and how much does it cost?

The permit costs $25 per year (for Woodbury County only) in addition to the regular off-road registration.

This permit allows ATV or OHV (side by side) to drive on rural roads (not four-lane highways). The vehicle cannot exceed 35 mph when traveling on these roads. Vehicle must have headlights, a horn, turn signals, and break lights.

How much does a lifetime hunting or fishing license cost?

The cost for each is $61.50. The customer must be 65 or older.

I am a disabled veteran, is there a special hunting or fishing license for me?

Yes, please contact our office at 712-279-6492 for details.

Is there a disabled/low income hunting or fishing license??

Please contact our office at 712-279-6492 for applications.

Motor Vehicles

How can we pay vehicle registrations?

Payment methods for vehicle registrations:

- on the Iowa Treasurers website

- in person

- by mail

Visit Woodbury County's Registration Renewals webpage for more information.

Do I have to have an appointment?

Walk-ins are accepted for all Treasurer's Office services unless you need four (4) or more title transfers.

You do have the option to schedule an appointment at the Sioux City location for any Treasurer's Office services. Click here to schedule an appointment.

- For those needing four (4) or more titles transferred, please call our office at 712-279-6500 to schedule an appointment.

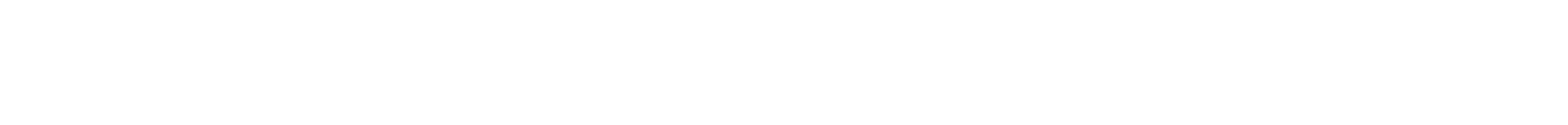

If paying registration online, where can I find my PIN or Audit Number?

You can use either the PIN or the Audit Number to renew online.

The PIN is specific to you and should not change, so you can use it from year to year.

- The PIN is located on your renewal notice in the top right-hand corner.

- If your renewal notice does not contain a PIN or has a "STOP" sign, you are not eligible to renew online. Please refer to the back of the renewal notice for more information.

The Audit Number can be found in the bottom left portion of your current vehicle registration.

Can I put a vehicle title into someone else’s name?

The new owner needs to be present at the time of transfer or have the appropriate forms completed beforehand.

If you are transferring a title on behalf of another person (i.e., acting as a runner), the owner(s) may download Form 411007 from the Iowa DOT website. The owner(s) must complete the form in its entirety and sign and date. If there are any cross-outs, alterations, incorrect, or missing information on the application, the owner will be required to complete and sign a new application. Postage will be collected at the time of processing, and the title will be mailed to the owner's address on file.

- If an owner wishes to authorize the Woodbury County Treasurer's Office to release their title, plates, and/or registration to another person (i.e., the runner), the owner may complete a Consent/Release Form. This form must be notarized to be valid.

- If the owner has a change of address, they will be required to update their Iowa driver's license first or come to the Treasurer's Office in person to complete their title transfer.

How do I get an Iowa replacement title?

Complete the Application for Replacement of Iowa Certificate of Title (Form 411033) and submit it to any county treasurer in the state of Iowa with the title fee. All owners listed on the face of the title MUST sign the replacement title application.

If the original title is lost, there is a 5-day waiting period for the replacement title.

If the original has been altered or damaged, submit the original title with the completed application and a replacement title will be processed the same day.

How do I order personalized/vanity license plates?

Most personalized license plates can be ordered online on the Iowa DOT website.

I have a salvage title. How do I get the vehicle inspected?

You must complete the Affidavit of Salvage Vehicle Repairs form and pay the inspection fee on the Iowa DOT website. Once you have completed the affidavit, you will need to schedule an inspection with a certified peace officer.

For more information on salvage titles and salvage vehicle inspections, please visit the Iowa DOT website.

Questions about abandoned vehicles?

Visit the Iowa DOT website for more information.

Plate Replacement Cycle

What is the Plate Replacement Cycle?

The Plate Replacement Cycle is a program that the Department of Transportation has implemented for license plates that are 10 years old or older and are still on a vehicle. The life span of a license plate is about 10 years. The goal is to replace those plates so there will never be a license plate on any vehicle over 10 years old.

When did the replacement plate cycle start?

The replacement plate cycle started on April 1, 2012 for the May 2013 registration renewal month.

When am I eligible to be reissued new plates?

| If your plates were issued in: | The plate will be replaced in: |

| 2011 | 2021 |

| 2012 | 2022 |

| 2013 | 2023 |

| 2014 | 2024 |

| 2015 | 2025 |

| 2016 | 2026 |

| 2017 | 2027 |

| 2018 | 2028 |

| 2019 | 2029 |

| 2020 | 2030 |

What should I do with my old plate that I have on my vehicle?

You should recycle your old plate. You are not required to turn in the plates to the County Treasurer. The Vehicle system will record that new plates have been issued to a customer.

Were there changes to the license plate design?

In 2018 the County Standard plate design was updated to the “City and Country Reboot,” which features city and country images in the top blue border. In July 2011 the numbers and letters on the plate changed from blue to black color. In November 2011 the zero was changed to a circle slash zero to assist law enforcement.

Were the postage and handling fee increased because of the plate replacement?

No. Due to the higher cost of mailing envelopes and packages from the postal service, the cost of mailing a set of plates has increased. The cost to mail a set of plates is $5.00. The cost of mailing a registration with a tag is $1.00.

If my plate on my vehicle is still readable and looks okay do I have to get a new plate?

If your plate is 10 years old or older, you have no choice. The vehicle system is programmed to automatically issue a replacement plate.

If only one of my vehicles is due for a replacement plate this year, can I get new plates for my other vehicles so that all of my plates are in sequential order?

If you choose to replace plates outside of your plate replacement period, you will be charged a $5 replacement plate fee. You will also need to turn in your old plates and current registration. If you do not have the current registration to turn in, we will accept the plates alone.

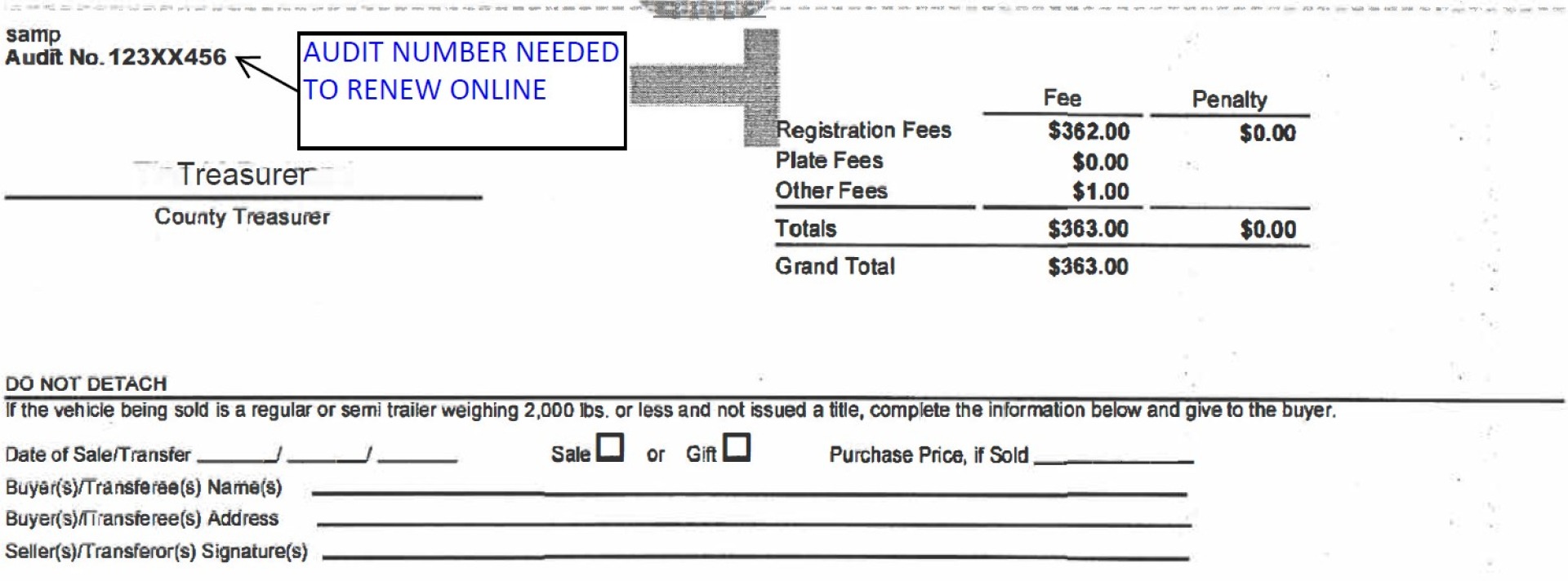

I just received my renewal notice in the mail, how do I determine if I am getting new plates?

The front of the renewal notice will have a ‘Y’ in the ‘Plates’ column field.

Property Tax

When are property taxes due?

Because we run on a fiscal year and not a calendar year:

- First half taxes are September 1st, delinquent October 1

- Second half taxes are due March 1st, delinquent April 1

If a customer wants to pay the full year taxes at one time, they will typically pay the whole year in September.

How can we pay taxes?

You may pay by any of the following convenient ways:

- Through the mail. Postmark must be by September 30 for the first half payment and March 31 for the second half payment to avoid penalty.

- In our office from 8:00 a.m. to 4:30 p.m.

- Online through the Iowa Treasurer's website. You must have the 5-digit receipt number located on your tax statement available.**

** If you do not have your tax statement, you may access a copy by scrolling down to the Tax History section of the Treasurers website.

When do I receive my property tax billing/statement?

Taxes are billed every fall and statements typically go out in the mail in mid-late August.

Where can I find my receipt number to pay taxes online?

Your receipt number is printed on your statement. You can also find it on the Iowa Treasurers website under the tax history section in the right column.

Where do I find out what I paid for taxes last year?

Your payment history can be found on your annual statements and also online through the Iowa Treasurers website.

Where do I file for homestead credit?

Almost all credits are applied for through the Assessor's Office. To apply for a homestead credit/exemption, please contact the City Assessor for all properties located within the Sioux City limits. For all other properties contact the County Assessor.

- The only credit handled by the Treasurer’s Office is the Disabled/Senior Credit. Please visit the Property Tax Credits page for more information.

What is the penalty if property taxes are paid late?

A 1.5% penalty is assessed per month after the due date.

What and when is a tax sale?

The tax sale is the sale of any unpaid property taxes within the county as of the first part of June. The tax sale is held electronically on the third Monday in June.

Stay Connected with Our County

Stay Connected with Our County